Donald Trump announced on Friday that the United States would impose additional tariffs of 100% on imports from China, effective November 1. Following these threats from President Trump, the global price of gold has been subject to continuous fluctuations due to its impact on several global economic factors, most notably inflation rates, interest rate movements, and geopolitical tensions. The price of gold against the dollar is one of the most widely researched indicators, given its importance in determining gold trading opportunities. The price is determined on international exchanges and is usually expressed in US dollars.

Therefore, monitoring the price of gold against the dollar is essential for investors and analysts, as the change in price reflects the strength or weakness of the dollar in the global market. To understand current trends, traders turn to a gold price chart, which shows price movement over different time periods.

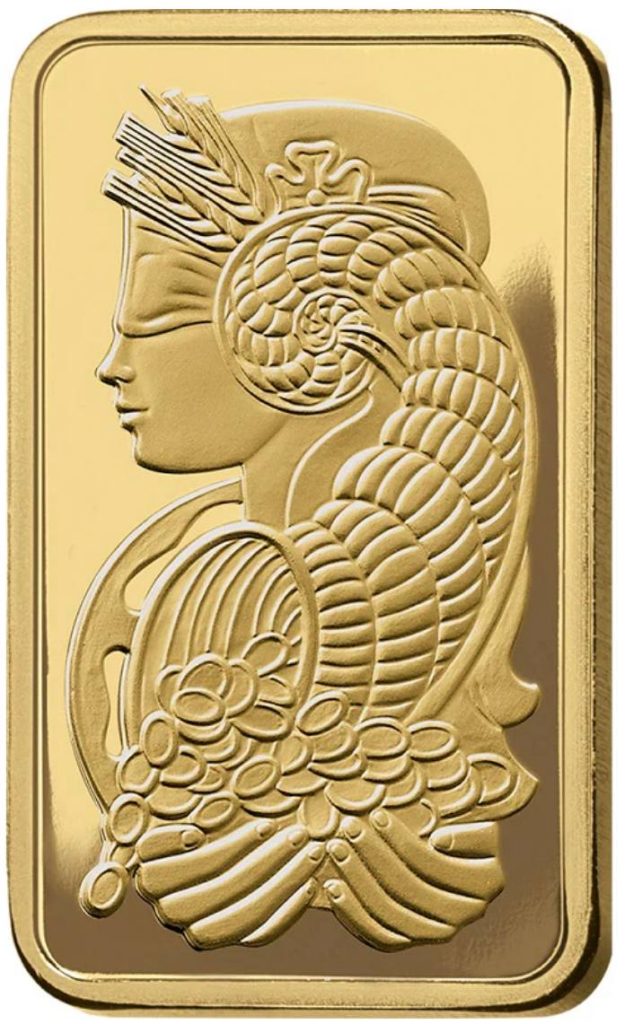

The price of gold is widely followed in financial markets around the world. Gold was the foundation of economic capitalism for hundreds of years until the abolition of the gold standard, which expanded the fixed currency system where paper money was not implicitly backed by any physical form of liquidity. AU is the symbol for gold on the periodic table of elements, and the price above is gold priced in US dollars, the common measure of gold’s value worldwide.